- Juneau Assembly OKs $1M loan to revive downtown Gross-Alaska Theatre for housing

- What to Know About Beast Games’ Controversial Sweepstakes Partner MoneyLion

- Personal Loans vs. Payday Loans: 10 crucial differences you need to know

- How a Boomer Got Rid of $155,000 in Student Loans Via Bankruptcy

- Affirm partners with Sixth Street

Bạn đang xem: SBA’s biggest lending program is expanding. So are its problem loans

While the Small Business Administration’s biggest lending program is experiencing strong growth and could equal its record annual funding total in 2025, defaults are also trending higher, posing a potential day-one challenge for

A businesswoman who served as a senator from Georgia in 2020 to 2021, Loeffler is poised to take over an agency whose flagship 7(a) lending program is operating at near-record levels. The program approved loans totaling $31.1 billion in its 2024 fiscal year. That’s more than any 12-month period except for the post-COVID fiscal 2021, when SBA waived fees, increased its guarantee to 90% and made six months of borrowers’ principal and interest payments, part of a broader effort to stimulate the economy.

SBA reported 7(a) approvals totaling $36.5 billion in fiscal 2021. At least one prominent SBA lender, Mark Gibson, national sales manager at the $5.8 billion-asset First Internet Bank in Fishers, Indiana, believes the program could match that number in fiscal 2025 — which began Oct. 1 — as small business optimism soars. “Our demand continues to increase,” Gibson said in an interview. “Small business optimism is increasing. With existing demand and support we expect to receive from the new administration, we too are optimistic.”

President-elect Trump is set to retake the White House in January.

SBA lending volume under 7(a) in October and November totaled $5.3 billion, an expansion of 26% over the first two months of fiscal 2024. The program offers guarantees ranging from 50% to 85% on loans up to $5 million.

More billion-dollar players

With 7(a) in high gear, the number of lenders making at least $1 billion of 7(a) loans annually will likely trend up too, Gibson said. Three banks topped the $1 billion threshold in fiscal 2024:

Xem thêm : 3 home equity loan risks to know going into 2025

“I think you’ll see six, maybe seven billion-dollar lenders within the next few years,” Gibson said. “There’s plenty of activity out there, and once you establish a reputation in the market and have capacity, you can expect to see growth as long as you’re doing a good job of it.”

First Internet, which had $580 million of 7(a) approvals for the SBA’s fiscal year 2024, up 27% from SBA fiscal 2023, focuses much of its efforts on funding merger-and-acquisition and expansion activity among small businesses. Business in that sector remains brisk, according to Gibson. “We continue to see a steady flow of requests and M&A demand for the foreseeable future, likely for the next three or four years,” Gibson said.

Through the first 10 weeks of fiscal 2025, First Internet has approved 7(a) loans totaling $122.5 million, according to SBA. “We’re exceeding our own expectations, year-over-year right now,” Gibson said.

A bigger problem-loan headache

Outgoing Administrator Isabel Casillas Guzman sounded a similarly optimistic note in a Nov. 14 press release touting the more than 20 million business applications she says were filed during the Biden Administration’s four years. “When taking the measure of our economy, business startup activity is a clarifying metric — and in the last four years, Americans have powered our economy through entrepreneurship,” Guzman said.

Ting Shen/Bloomberg

Guzman has presided over record levels of activity since becoming administrator in March 2021. Still, her leadership has come under

The revised guidelines, which permit lenders to use their own underwriting standards for similarly sized non-SBA loans up to $500,000, replaced a more prescriptive version. Collateral and equity were similarly softened. SBA said the changes were intended to streamline and simplify the lending process, reducing the burden on borrowers and lenders. Critics, however, are concerned the revisions went too far, eliminating important guardrails intended to buttress overall credit quality. They’re arguing for a course correction in 2025.

“We’d like to see that policy rolled back a little bit and kind of reinstitute the previous credit standard,” Arne Monson, president and co-founder of the Memphis-based Holtmeyer and Monson, a leading SBA lender servicing firm, said in an interview.

SBA statistics do show an increase in purchases, instances where the agency honors its guarantee and pays for a portion of a lender’s loss on a poorly-performing loan. Purchases, which totaled $572.7 million in fiscal 2021, have risen every fiscal year since — including a 51% jump in fiscal 2024, to $1.61 billion. SBA, for its part, attributed the increase to the phase-out of stimulus programs, which “naturally led to an increase over the historically low default rates of the pandemic.” Present default rates, SBA added, “are in line with loan performance seen before the pandemic.”

“Systematically bad loans and systematically bad lenders bring down the entire program,” Nimi Natan, president and CEO of Gulf Coast Small Business Lending, the SBA lending unit of the $3.3 billion-asset Gulf Coast Bank and Trust in New Orleans, said in an interview. “I don’t know if we have that problem. I don’t know if this is just getting off the sugar high of [stimulus spending]. It could be. I think there is enough there to hope the new administration and the SBA would look at the data and say, ‘Okay, we have a spike. Let’s do something about it, early on.'”

Other observers point, at least in part, to the 2023 policy change. They’re calling for tightened standards and an increase in oversight. Monson said he’d like to see more focus on collateral and stricter equity requirements.

“We can make a direct correlation between, you loosen credit standards, a year-and-a-half later, you’re going to have more guarantee claims or defaults,” Monson said. “We have a department that handles guarantee claims and liquidations. Over the past 24 months, that activity has tripled.”

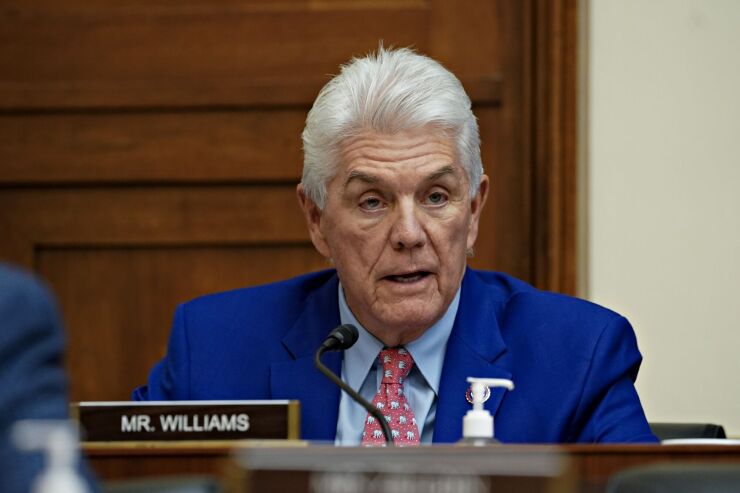

The issue has caught the attention of some lawmakers, including House Small Busiiness Committee Chairman Roger Williams, R-Texas.

Al Drago/Bloomberg

“Since the recent rule changes to the 7(a) lending program, I have consistently warned that the Small Business Administration is putting the integrity of the program at risk,” Williams said in an email to American Banker. “Unfortunately, the rising default rates we are now seeing confirm my concerns. “

Gibson acknowledged that the rule changes were motivated by a desire to broaden access to capital. Even so, he is expecting some “pull-back” by the new administration. “There may be more lender oversight, which is good,” Gibson said. “The more lender oversight we have, the better off I think we are as an industry.”

“The ship is absolutely not sinking,” Natan said. “But, we’ve got a leak. Let’s figure out where that leak is and let’s patch it.”

Nguồn: https://marketeconomy.monster

Danh mục: News