- S&P Upgrades PenFed Auto Loan Securitizations Due to Strong Performance

- Biden student loan forgiveness to benefit 55,000 public employees

- Kenyan aid group is enabling refugees to access loans

- Potsdam Specialty Paper qualifies for disaster loan, but fund is out of money

- El Salvador Bows to IMF, Agrees to Bitcoin Restrictions for $1.4B Loan

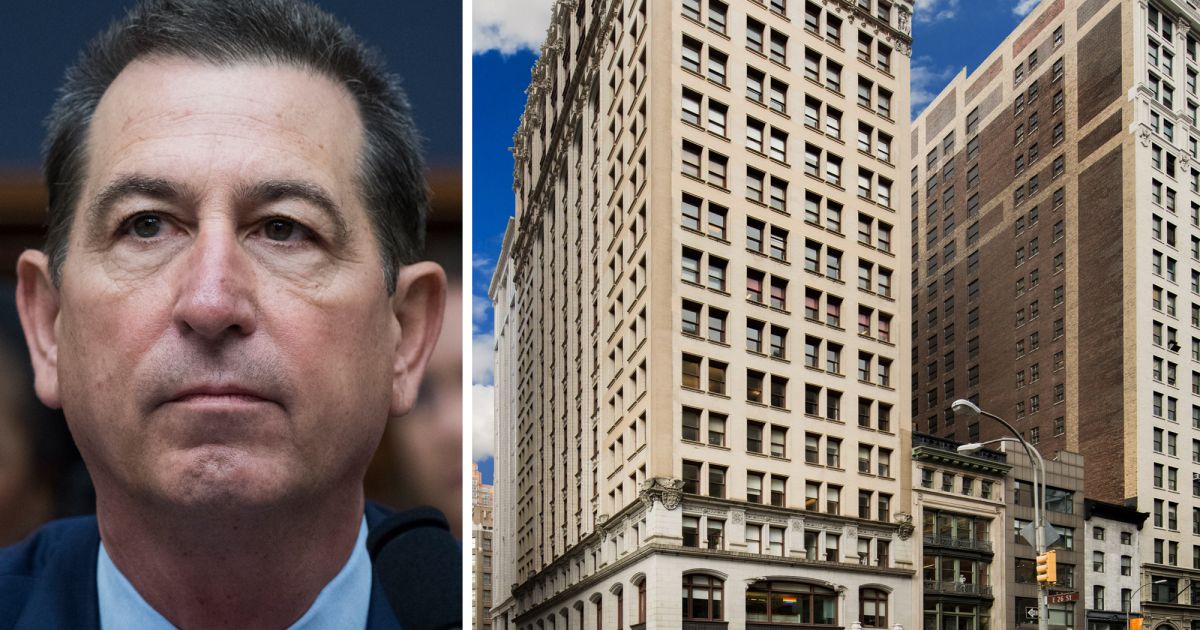

Flagstar Financial, a rebranded name for New York Community Bank (NYCB), is eyeing the sale of $343 million worth of troubled New York City loans on its balance sheet.

Bạn đang xem: Flagstar Bank Unloading $343M of Struggling NYC Loans – Commercial Observer

The company, which changed from NYCB to Flagstar in October, seven months after nearly collapsing, is selling eight sub-performing loans for office and retail assets in the Big Apple, The Real Deal reported Tuesday afternoon.

Xem thêm : Best Boat Loans 2025

The debt package Flagstar is unloading includes an $80 million loan in 2022 from NYCB for the leasehold on Steller Management’s office building at 220 Fifth Avenue at the corner of Fifth Avenue and 26th Street northwest of Madison Square Par, according to TRD.

Another 2022 loan for sale is the $77 million loan NYCB supplied to refinance Olnick Organization’s office property at 130 Fifth Avenue at the corner of Fifth Avenue and 18th Street, TRD noted, and the $66 million loan from 2013 backing RXR’s Standard Motors Building at 37-18 Northern Boulevard in Long Island City.

Xem thêm : Top creditor China has not approved any loans to Cambodia so far this year, data shows

Newmark (NMRK) is leading the loan sale with a team led by Adam Spies and Josh King. A marketing memo from Newmark said the debt package also includes loans for two additional office assets and two retail condos in Manhattan with properties in the portfolio containing “challenging capital stacks.”

Officials for Flagstar did not immediately return a request for comment. Newmark declined to comment.

Andrew Coen can be reached at [email protected]

Nguồn: https://marketeconomy.monster

Danh mục: News