- How car loans became Britain’s latest consumer finance scandal

- AC Milan are weighing up a January loan move for Marcus Rashford – with wantaway Manchester United forward’s name thrown forward to Italian giants’ chief Zlatan Ibrahimovic amid their frontline injury issues

- Bitget Elevates Institutional Loans (Spot) Service with Advanced Features for Institutional Users

- What to know about student loans before the White House transition

- Breaking: Bayern Munich sends Aussie phenom Nestory Irankunda on loan to Grasshopper Club Zurich

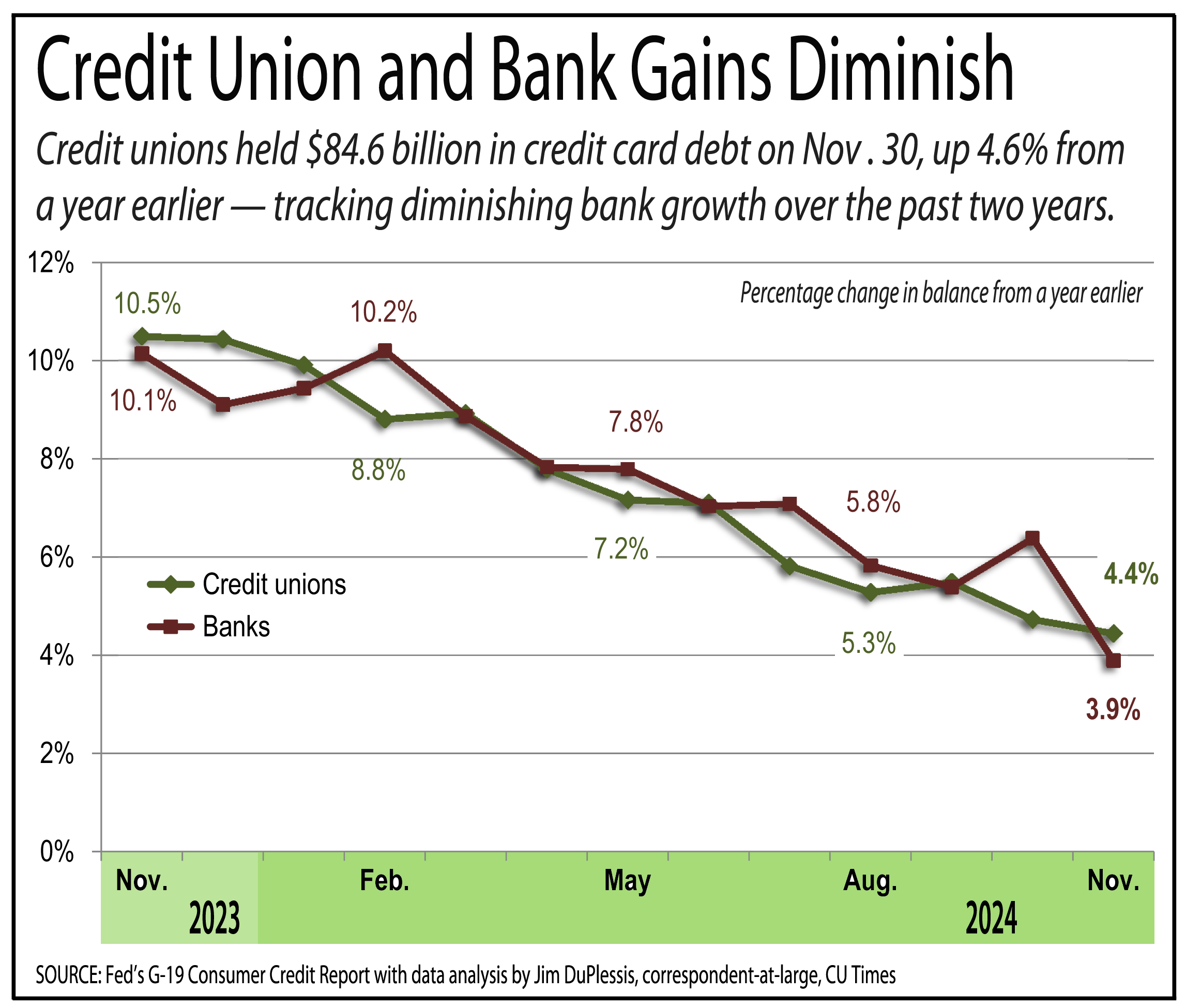

The Federal Reserve’s G-19 Consumer Credit Report released Wednesday showed credit unions held $84.6 billion in credit card debt on Nov. 30, up 4.4% from a year earlier. The change from October to November was 0.6%, less than half the average October-to-November gain of 1.5% from 2014 through 2023.

Bạn đang xem: Credit Cards, Auto Loans Still Underperforming for Credit Unions

Credit unions’ share of credit card debt was 6.3% in November, unchanged from October and up from 6.2% in November 2023.

Banks have been gaining share, and the only way credit unions have gained share is from the small amount held by others. Finance companies held $18.1 billion in credit card debt, down 12.5% from a year earlier and down 0.4% from October, compared with a 10-year average drop of 0.6%.

Banks held $1.22 trillion in credit card debt on Nov. 30, up 3.9% from a year earlier. The gain from October was 1%, less than half the 10-year average gain of 2.4%. Banks’ share of credit card debt was 90.9% in November, unchanged from October and up from 90.7% in November 2023.

Besides credit cards, the Consumer Credit Report measures non-revolving loans. For credit unions and banks, that’s mainly auto loans and personal loans. In the case of credit unions, auto loans were 87% of this group in October, so the G-19 is a good indication of how auto lending is faring at credit unions.

Auto lending has generally been faring terribly at credit unions, but November indicated a slight bounce — either from personal loans or car loans.

In the last 13 months, the month-to-month change for non-revolving loans at credit unions has been negative eight times, flat twice, twice up 0.1% and once rose a “record” 0.2% in July.

November was a 0.1% gain, well below the 0.3% 10-year average for the month. Credit unions held $568.8 billion in non-revolving consumer loans in November, down 2.2% from a year earlier.

Credit unions’ share of non-revolving loans was 15.2% in November, unchanged from October, but down from 15.6% in November 2023.

Banks held $900.6 billion in non-revolving consumer loans in November, down 2.1% from a year earlier and up 0.2% from October, bettering the 10-year average gain of 0.1%.

The Monthly Credit Union Estimates to be released soon by America’s Credit Unions will show whether the November gain in term loans was caused by the continuing growth of personal loans, or showed a reversal or slowing or losses in automotive loan portfolios at credit unions.

Its report for October showed record low loan growth overall and the biggest drop in automotive loans in at least 10 years.

Nguồn: https://marketeconomy.monster

Danh mục: News