- South Shore real estate company owner sued again

- Bayern Munich loan Socceroos prodigy Irankunda to Grasshoppers

- Mayor Brandon Johnson’s latest Chicago budget includes $40M loan – NBC Chicago

- Is Student Loan Forgiveness Blocked For Your Program? Here’s A Breakdown

- $10 billion in government loans announced for EV companies – pv magazine USA

MyPillow founder Mike Lindell has once again found himself staring down the wrong end of a seven-figure lawsuit, this time being dragged into court by a merchant cash advance firm that accuses the bedding magnate and election fraud conspiracist of ducking out on nearly $1.5 million in outstanding debt.

Bạn đang xem: Cash advance firm sues Mike Lindell for refusing to pay back $1.5 million loan

Cobalt Funding Solutions, a New York City-based “alternative capital provider,” makes loans to businesses against their future sales, taking a set portion of a company’s revenues until the principal is repaid, plus a handsome premium. Lindell, for his part, has called the entire future receivables industry a “sham,” and drew first blood against Cobalt earlier this month with a lawsuit claiming the whopping 409 annual percentage rate it charged him while in a desperate cash crunch was “illegal,” “usurious,” and a legalized form of loan sharking.

Now, Cobalt has returned fire in a civil complaint filed last Friday in state court. Although the 63-year-old MAGA fan has stopped paying, the complaint says he has “continued to generate and collect millions of dollars in revenue from sales of, among other things, Pillows and bedding accessories since October 18, 2024.”

Reached by phone on Monday, Lindell told The Independent he had not been previously aware that Cobalt was countersuing and had not yet reviewed any of the court filings.

Xem thêm : Vallejo City Council creates business loan program after no confidence vote on $245K economic plan

He claimed, without providing specifics, that Cobalt has “gotten in trouble before” for its business practices, and that “there was a lot of stuff that went around with that,” but that “they keep doing what they’re doing.” However, Lindell continued, “I don’t know what it all involves.”

As for Cobalt’s lawsuit against him and MyPillow, Lindell said, “I just don’t want to get out in front of things here. The lawyers are handling that. It’s not my priority right now, I’m trying to run companies and get rid of the electronic voting machines. That’s my focus.”

In an email on Monday, Christopher Murray, the attorney representing Cobalt in court, declined to comment on the case, citing firm policy.

Merchant cash advances, also called “factoring” arrangements, are not subject to usury laws.

The ugly dispute between Lindell and Cobalt dates back to September 16, when Cobalt paid Lindell about $1.5 million for $2.2 million in expected MyPillow receipts, according to the complaint.

Xem thêm : Breaking The Stigma And Fighting Bias Around VA Home Loans

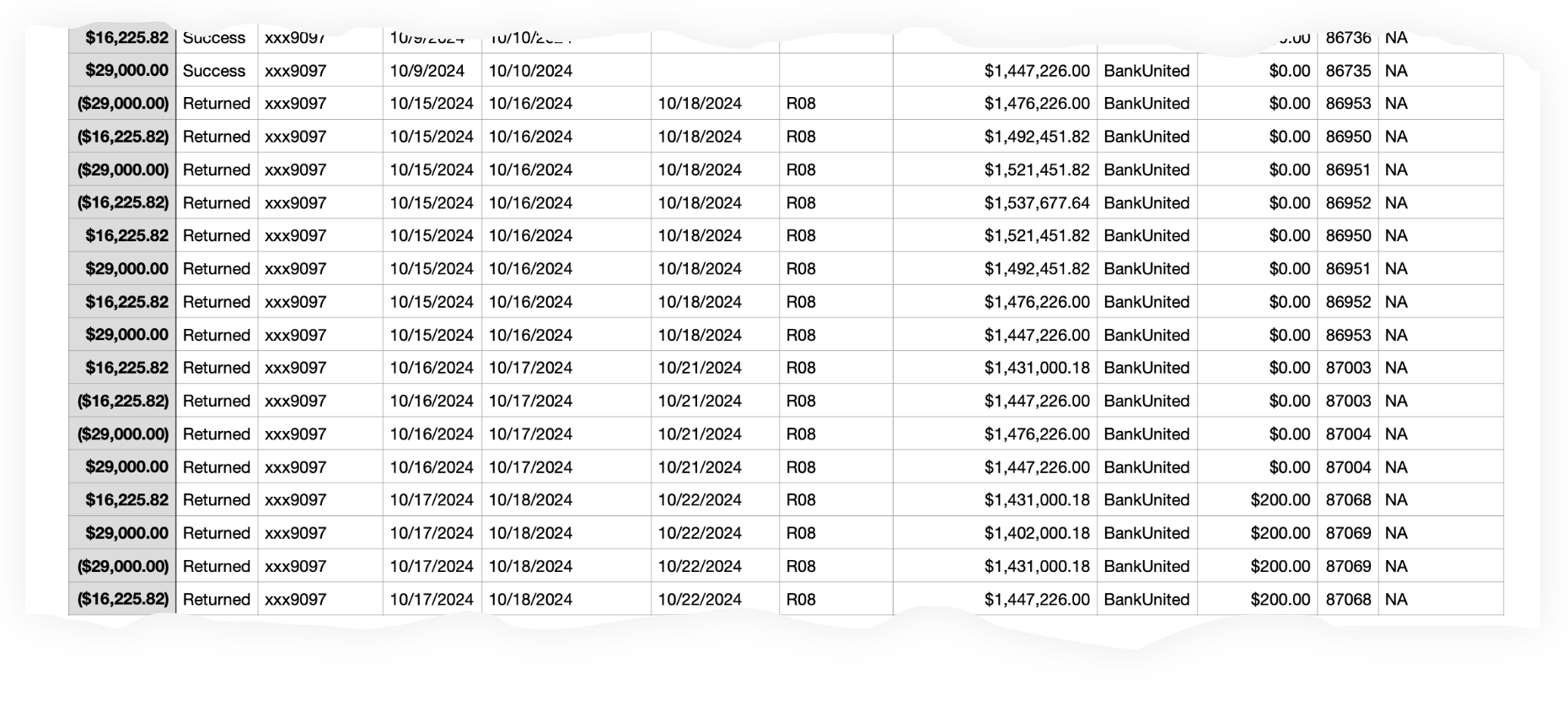

From that point on, Cobalt would debit MyPillow’s bank account each business day for $45,000, an estimated 7.57 percent of its proceeds, a spreadsheet attached to the complaint shows. Lindell made regular payments through mid-October, for a total of $814,064.76, Cobalt’s complaint states. But it says Lindell suddenly cut off Cobalt’s access to the account, and has prevented it from debiting the rest of the money due under the contract — $1,447,226, plus $200 in blocked payment fees charged by the bank — as agreed.

Since then, Lindell, who personally guaranteed the loan and is himself liable for it, has “refused to resume” making payments, according to the complaint.

After Lindell launched a personal crusade to “prove” the 2020 presidential election was stolen from Donald Trump, his products were dropped by big box retailers and the cash-strapped MyPillow was evicted from its Minnesota warehouse over unpaid rent. He has been dropped by his attorneys over millions in unpaid fees, ordered by a judge to pay $5 million to a computer programmer who disproved his claims of voter fraud, and continues to battle defamation suits by America’s largest voting machine companies over Lindell’s false allegations. In September, Lindell was sued by a California vendor for ignoring bills adding up to the mid-six-figures.

The following month, Lindell found himself in a near-identical situation with another cash advance company, Lifetime Funding, which accused the bedding kingpin of stiffing it for some $600,000 in receivables. In that instance, Lindell also sued Lifetime, railing against what he said amounted to a sky-high 441 interest rate.

At the time, Lindell told The Independent, “We’re going after them. It’s all very illegal. There’s up to 1,000 percent interest, it breaks all kinds of laws.”

Nguồn: https://marketeconomy.monster

Danh mục: News