- Student loan service providers face new allegations of illegal practices

- Best Personal Loans for Debt Consolidation for December 2024

- HTX’s Flexible Crypto Loans Goes Viral and May Spark a New Lending Trend in the Bull Market

- Access to Auto Credit Improves in November

- The Benefits of FHA Loans for First-Time Buyers in Colorado

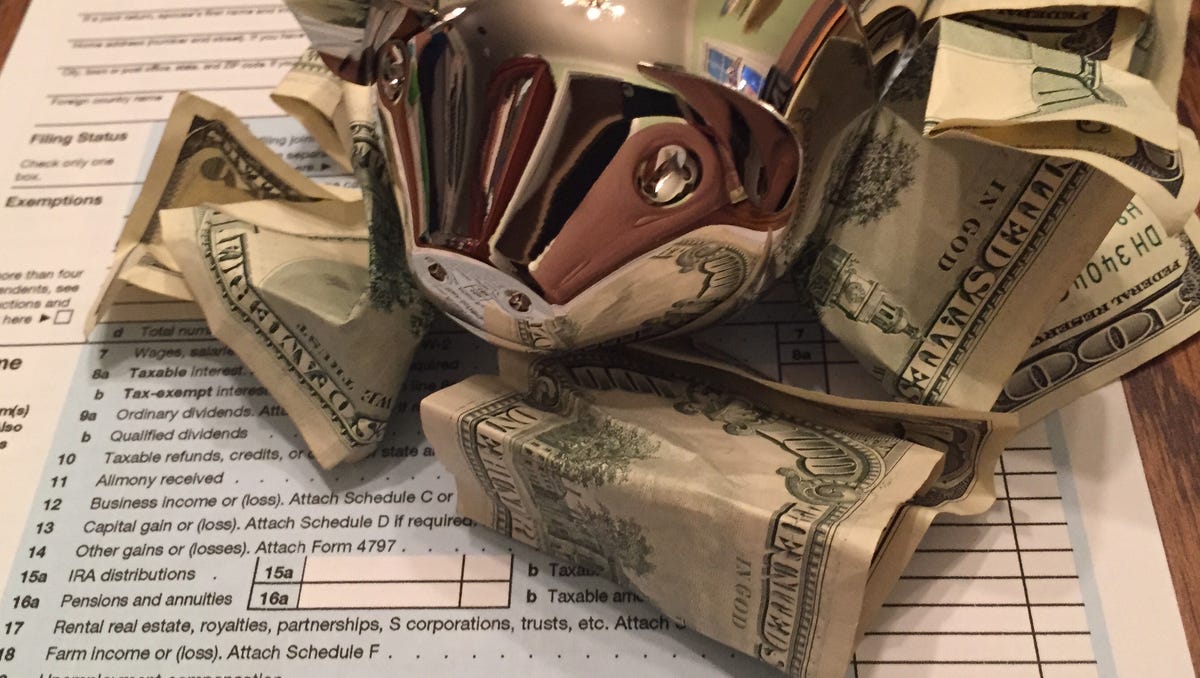

IRS unveils new income tax brackets and deductions for 2025

Bạn đang xem: Loan on your 2024 refund will cost you

The IRS has announced key tax changes for 2025 due to inflation, including adjustments to income tax brackets, deductions, and capital gains.

Straight Arrow News

Try to cover your holiday spending by taking out a loan against how much money you might get for your tax refund next year? Oh, it’s being suggested all right.

The early tax refund advance season hits in December, months before many people would actually receive tax refunds after filing their 2024 federal income tax returns next year. But amazingly, it’s just in time to fill Santa’s sleigh.

Starting Dec. 16, for example, Jackson Hewitt notes online that it’s possible to get up to $1,500.

The Jackson Hewitt ad online features Santa’s smiling mug and $100 bills flying in the air. A red ribbon marks the spot on a yellow tag proclaiming: “Money Today Guarantee.”

“Your holidays just got happier,” the online site reads.

It’s not a cheap way to borrow — far from it.

It would cost you roughly $111 in finance charges — or an estimated annual percentage rate of 35.96% — to get $1,500. You’d pay a little bit more than $22 for a $300 loan. These loans are available through Jan. 12. Your loan gets automatically repaid after you file your tax return with your tax refund.

A variety of tax refund-related financial products exist — including early tax refund loans, no-fee refund advance loans during the tax season, and refund anticipation checks that often are used by people who don’t have money to pay their tax preparation fees on the spot.

But there’s a growing concern that consumers don’t always understand all the costs associated with such products — or know about many alternatives for getting their taxes prepared for free.

Nearly 16% of tax returns used refund-related products

A new report issued in November by the Treasury Inspector General for Tax Administration indicated that 21.9 million — or 15.9% — of 2023 federal income tax returns used a refund-related product, such as a refund anticipation check or a refund anticipation loan.

Yet, consumers in some cases need to dig deep into the fine print or go through multiple pages of information to discover what they’re paying for these services. Those offering the services, the report declared, aren’t always making it easy for taxpayers to find key information.

One big risk, as noted in the TIGTA report: The taxpayer who takes out a refund anticipation loan could be on the hook to the lender for additional interest and other fees “if the financial institution does not receive a direct deposit of the taxpayer’s refund within the expected time frame.”

Taxpayers spent more than $842 million in estimated fees to use a refund anticipation check to file their 2023 federal income tax returns, according to TIGTA, which provides independent oversight of the Internal Revenue Service.

Refund anticipation checks — where the average fee was $40 — enable taxpayers to avoid paying tax preparation fess up front. Instead, part of their actual refund is used to cover those costs. Tax filers do not receive any of their refund money before the refund is issued when refund anticipation checks are used.

The bulk of those 21.9 million filers highlighted in the TIGTA report — 96% — used refund anticipation checks.

The costs are likely even higher for taxpayers taking out advances. When it comes to refund anticipation loans, taxpayers could be looking at interest rates of around 35%, according to the report.

One provider — none were listed by name — promoted an advance loan product that was offered from Nov. 1, 2023, through Dec. 31, 2023, that had a rate of 35.9%, the report said. The loan had to be repaid by March 31, 2024, or additional fees and interest would apply. The loan limit was $1,300.

While such terms might seem doable, especially when you want the cash early, risks remain, including potential lengthy delays in getting your refund to repay the loan. The delays can drive up your costs. Terms and conditions for refund anticipation loans vary.

Xem thêm : Time is Running Out to Cancel Debt for Aging Borrowers

On average, the report noted, it took the IRS 28 days to issue these refunds after it received the tax return for processing. Worse yet, 6% of tax returns filed this year with a fee-based refund anticipation loan are still awaiting a refund, according to the report.

“These tax returns have been in process for an average of 143 days,” the report stated. “One common reason for the delay is that the taxpayer’s account was flagged for identity theft.”

Another key point: The IRS could spot errors and make adjustments to your tax return, which could end up reducing the amount of the refund. The average refund for taxpayers who elected to receive a fee-based refund anticipation loan, the report noted, as $6,696.

Typically, the amount for a refund anticipation loan will be far less than your anticipated refund. Even so, if you end up with a much smaller refund than expected or end up owing money, you could run into trouble when it comes to paying off the loan.

TIGTA said it was unable to give an estimate for how much money consumers spent on refund anticipation loans since IRS does not capture the amount of the refund that was subject to the refund anticipation loan.

The report also urged the Internal Revenue Service to consider updating its own website to “educate taxpayers about the fees and potential costs of using refund products.”

Why some spend an extra $25 to $55 to file a tax return

What’s troubling is that many taxpayers don’t have the money on hand to cover their tax preparation costs so they take on an extra cost to file as early as possible.

The fees connected to using a refund anticipation check ranged from $22 to $55 based on what was charged by the top seven providers during the filing season this year, the TIGTA report stated. That fee is on top of other charges for actual tax preparation services.

Some tax filers, according to experts, use refund anticipation checks as a way to get around not having their own bank accounts and being unable to use direct deposit. Direct deposit is a quicker way to receive a tax refund than waiting for a check in the mail for six to eight weeks. Refunds for e-filed returns with direct deposit can take less than 21 days.

The so-called unbanked tap into a deal using a refund anticipation check offered by a tax preparer to get a new pre-paid debit card to get their refund more quickly. The tax preparer works with a bank or lender that opens these accounts. Other fees could apply when you’d use the prepaid card, too.

Nina E. Olson, executive director of the nonprofit Center for Taxpayer Rights, told me in a phone interview that low- to moderate-income families who qualify for the earned income tax credit face added challenges in covering the costs of getting their tax returns prepared or dealing with not having a regular bank account.

Use of refund-related products was much higher, she added, in the 2021 tax year as taxpayers were even more eager to file returns for stimulus-related tax breaks. Then, the TIGTA report noted that 24.9 million taxpayers used refund anticipation checks, refund anticipation loans or both to file their returns.

Olson said she has been recommending for decades that the IRS figure out a way to offer a government-sponsored prepaid debit card for those who are unbanked to cut down on the use of refund anticipation checks. One such program went through a pilot test in 2011 but was later dropped.

Why Direct File could offer some relief

She also has been pushing for a system where taxpayers can file their taxes online directly through an IRS program to avoid high tax preparation costs. Olson served as the National Taxpayer Advocate, the voice of the taxpayer at the IRS, from March 2001 through July 2019.

“Direct File will help enormously,” Olson said, noting that those who used the program in the initial stages gave high ratings to their experience with it.

Beginning in 2025, more people in more states will be able to file their own taxes for free through a new program called Direct File being run by the IRS. Olson hopes that Direct File could cut into some use of refund anticipation checks to cover tax preparation costs.

More than 30 million taxpayers in 24 states will be able to take advantage of Direct File to prepare and file their federal income taxes online for free directly with the Internal Revenue Service next year. The program is expected to expand nationwide in the future.

The average U.S. taxpayer spends $270 and 13 hours filing their taxes, according to the federal government. Direct File, launched as very limited pilot program in 12 states in 2024, is designed to save do-it-yourselfers a buck and some time.

Other options exist, too. Many low-income to moderate-income people qualify for free tax preparation assistance at Volunteer Income Tax Assistance sites and Tax Counseling for the Elderly programs. In 2025, people who generally make $67,000 or less could qualify for these services.

Some volunteer sites also offer prepaid debit cards for direct deposit of refunds for unbanked tax filers. Accounting Aid Society, for example, offers a reloadable debit card for those who do not have bank accounts as a secure method for obtaining a tax refund in the most timely manner. The debit card is issued by U.S. Bank and called the U.S. Bank Focus Card.

It’s also possible for many people to use the Free File Program through the IRS.gov website to use free software to prepare your returns for free. The Free File program resumes in January. The guided tax software will be free in 2025 to those with adjusted gross incomes of $84,000 or less.

Xem thêm : Biden Cancels Nearly $4.3 Billion In Student Loan Debt: Here’s Who Benefits

The IRS Free File Program is a partnership between the IRS and many tax preparation and filing software companies who provide their online tax preparation and filing for free.

Vital social, safety-net benefits, such as the earned income tax credit and the child tax credit, are tied to filing a tax return. But people who need the money most really need to find lower cost options for filing and preparing their taxes.

Spending $300 on tax preparation services, plus extra fees, for some financially fragile families is like trying to deal with a $3,000 emergency car repair for many well-off families, Olson noted.

And $40 for a refund anticipation check is still $40. It’s money that could be used for food or to cover other necessities, such as a tank of gas.

The TIGTA report said the average refund amount for taxpayers who used refund anticipation checks was $3,841 — suggesting that many paid roughly 1% of their total refund to avoid upfront costs for tax preparation.

Another concern: Are you stuck paying for high-cost tax preparation fees if you take out a refund-related loan? Will you be locked into going back to the preparer to have your taxes done to cover those tax-refund related loans?

How holiday jingle intersects with taxes

Year-end tax planning shouldn’t be about trying to spend next year’s tax refund before you get it by applying for a tax-related loan. But many loans offered in November and December could entice you to do just that.

“I hate those things,” Olson said. “People will go and do that because it’s around the holidays and you can get some money to do stuff.”

Consumers can spot a variety of loan products. The H&R Block Emerald Advance Loan is promoted online as a fixed-rate, short-term loan from $350 to $1,300 as a way to “catch up on bills” and pay for “holiday shopping.”

The money is available the same day you apply. Applications started Nov. 1 and run through Dec. 31. You’d apply in-office at an H&R Block location. The annual percentage rate is 35.9% and you must repay your loan on or before March 31, 2025. If the loan is not paid in full within 14 days of its due date, you’d owe a $30 late fee and additional interest.

According to information posted online, you can repay with any debit card by phone or online, as well as by check or money order. Or, the site notes: “If you complete your taxes with H&R Block and receive a refund, you can choose to repay your loan from your tax refund proceeds.”

For some who found money tight unexpectedly in 2024, the short-term loans might have some appeal, especially if you can get cash immediately.

The online Jackson Hewitt ad notes: “Leave your local Jackson Hewitt with money in your pocket, if approved for an Early Tax Refund Advance loan on a prepaid card.” You’d need book an appointment or walk into a local office, including those set up in Walmart. You’d bring a recent paystub, a government issued ID and a Social Security card for each individual filing and anyone you plan to claim on your return.

To apply for an Early Tax Refund Advance loan, someone would need to book an appointment with a Jackson Hewitt tax preparer between Dec. 16 and Jan. 12.

The Jackson Hewitt loan notes that there is no credit check for its product. “Republic Bank does what is called a ‘soft credit pull,’ which does not impact a credit score,” according to a Jackson Hewitt spokesperson. “People may get approved even if they have poor credit history.”

The Jackson Hewitt Early Tax Refund Advance loan amounts are determined by the expected federal refund, less authorized fees and underwriting, the Jackson Hewitt spokesperson said. If approved, a finance charge applies. Loan amounts available are $100, $300, $500, $1,000 and $1,500.

To be eligible for the $1,500 loan, the consumer’s expected federal refund, less authorized fees, must be at least $4,600. Most approved applicants get loans for $300, according to the spokesperson.

“The amount owed is deducted directly from the client’s tax refund,” the spokesperson said. “If the tax refund is insufficient to pay the loan in full, tax refunds from returns filed in the following tax year with Jackson Hewitt may be applied to repay the outstanding loan balance, if applicable.”

In many cases, refund anticipation loans may be offered in January and promoted as having no fees. Next year, for example, H&R Block will offer its “Refund Advance” loan, a refund anticipation loan where the loan is automatically repaid from the borrower’s tax refund.

Tax filers receive up to $3,500 and may apply while filing their taxes between Jan. 3 and Feb. 28. No interest and no fees are charged for that loan, which can be taken out when you pay to file your taxes at H&R Block.

If you’re considering any of these products, though, take time to review the restrictions and consider the possibility that you might not qualify for as big of a loan — or end up with as big of an income tax refund — as you might expect. Also consider possible options for doing your taxes for free and e-filing at no cost.

Taking a loan on an anticipated tax refund that you won’t get until February or later should be treated as a last resort.

Contact personal finance columnist Susan Tompor: [email protected]. Follow her on X (Twitter) @tompor.

Nguồn: https://marketeconomy.monster

Danh mục: News